Table of Contents

Instant Payday Loans For Bad Credit In Arizona

If you live in Arizona, you are over 18 and you are looking for a cheap quick and safe way to get urgent cash advance, Paydayplus.net is the right place. We do not guarantee any miracles, but we do promise verified information, friendly service and all the necessary details you need to find the right lender with lower rates and fees, affordable terms and convenient online and in-store application. All you need to do is fill out a simple form which is processed within several minutes and if approved you get the money into your bank account the same or the following day. Bad credit is not a problem. Neither is a credit check. Applying won't damage your credit history. And paying off the loan will even help you raise the score.

Why Choose Paydayplus.Net Cash Advance In Arizona

Plus to quick funding of the necessary amount for a borrower with any credit type and with NO credit check you get:

How Payday Loans In Arizona Work?

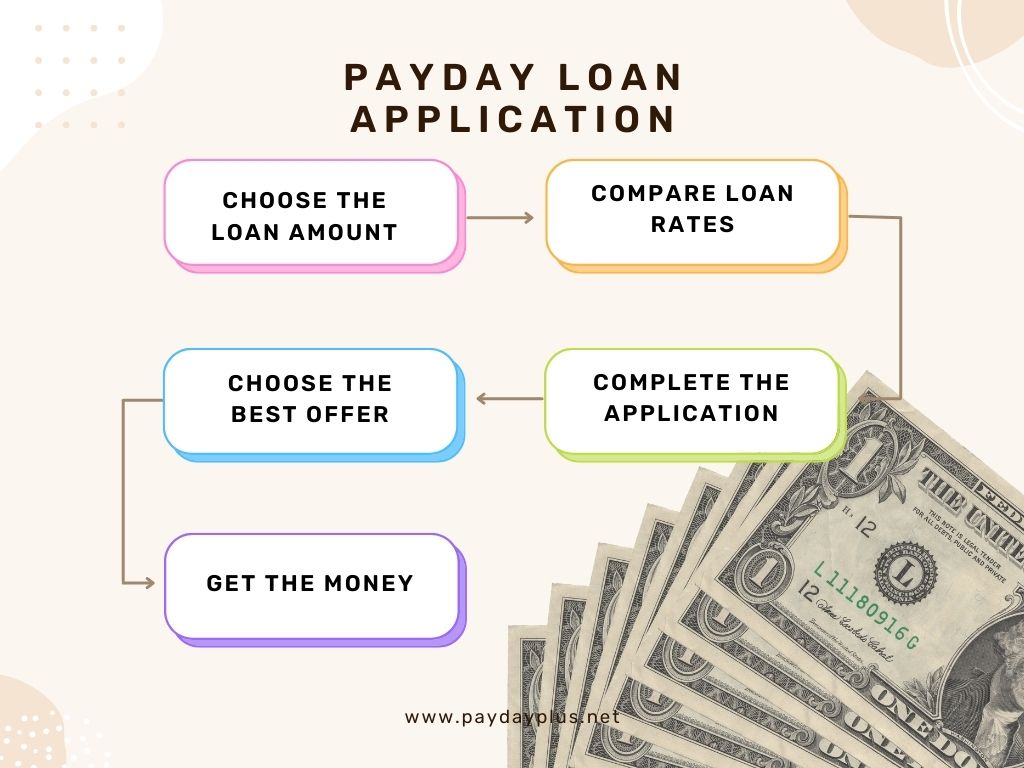

To apply for a Online Payday Loan for Bad Credit in Arizona follow these easy steps:

- use an internet-capable device and access an online loan application 24/7;

- application process will include quick gathering of the information necessary to make a lending decision. It's secure and is based on OLA guidelines, federal and tribal regulations. Every application is given special attention to consider factors beyond your credit score;

- as you are approved and verified, you get an access to the funds as soon as the next business day. The money may be deposited electronically into your bank account through a secured ACH transfer as long as you have been approved by 4:30 p.m., Monday through Friday;

- repay the loan automatically when it's due, usually in 14-30 days as soon as you get the next paycheck.

Follow these step-by-step directions and you'll feel all the convenience and pleasure of online borrowing with Paydayplus.net.

Arizona Payday Loan laws, rates and fees

|

Minimum Loan Amount |

100 $ |

|

Maximum Loan Amount |

1,000 $ |

|

Minimum Loan Term |

14 days |

|

Maximum Loan Term |

31 days |

|

Maximum APR |

36 % |

|

Additional Fees |

5% fee |

More information about how rates are formed for payday loans in Arizona, how they work and under what conditions you can get them is on the website investopedia.com.

A payday loan in 15 minutes - what is it?

When browsing the offers of lenders, you could often come across the slogan "loan in 15 minutes". This is nothing more than a payday offer considered at an accelerated pace, followed by the withdrawal of funds by express transfer. Of course, this name should not be taken literally - no one is counting down that exactly a quarter of an hour has passed from the acceptance of the application to the payment of funds. The said 15 minutes highlights how quickly the requested amount will reach our account. So it is the perfect solution in situations where unexpected expenses appear on the horizon. Flooded flat and need for renovation? Car breakdown and expensive replacement of a broken part? Or maybe a promotion for new electronics or last minute holidays? A quick online loan is best for these situations, without complicated procedures and additional income documents.

Online payday loans on weekend in Arizona

In the case of bank loans, the application may only be submitted during bank business hours. This is quite a problem when a sudden expense occurs at the weekend. While payment can be deferred, it will not be a major obstacle. The matter becomes more complicated when payments must be made immediately. Therefore, in such a situation, it is worth considering taking an internet loan available not only on weekdays. It doesn't matter when you want to apply for a loan. By submitting it on Tuesday, Friday, Saturday or Sunday, you have a chance to receive money "on the spot". In most cases, just 15 minutes is enough for the requested amount to be transferred to the indicated bank account. The money is available immediately, so that an unplanned expense or other purchase can be made almost immediately.

It should be emphasized that quick payday loans offered 7 days a week are available in most non-banking companies. At the same time, you must remember to apply for a loan at such times when a specific non-bank company accepts applications. As a rule, it is at least 1 hour before the end of the lender's work.

Bad credit payday loans

If you are a customer with bad credit, you can still apply for a payday loan in Arizona, because by law, even a bad credit history is not a barrier to obtaining loans. You can get a loan with any type and level of income, the main thing is to be an 18-year-old citizen of America. Before you fill out the application and get a loan, be sure to think it over again and decide exactly whether you will be able to pay off the loan within 30 or 60 days without unnecessary difficulties.

Warning On Arizona Payday Loans

While payday loans are very popular in the states that offer them, they come with a number of disadvantages you should be aware of. Payday lenders often charge excessive fees and high interest rates which are higher than credit card cash advances or personal installment loans.

If a borrower can't pay off a loan on time he tends to apply for rollovers and extensions which means taking out a new loan—with new fees—to cover the payment for the original loan. This can lead you to a continuous cycle of debt.

So, before taking out a Payday Loan think twice whether you can afford it, whether you are responsible enough to lan your budget so that to pay back the money on a due date.

Before applying for a short-term high-interest Payday Loan consider other alternatives. Most popular of them are credit card cash advances, personal installment loans, title loans, loans from banks or credit unions. They all differ by interest, repayment, amounts and terms. Find out all the details of each of them to choose the right for you.Payday Loan Alternatives: