Payday Loans from Direct Lenders

Today, payday loans are becoming more and more popular. This is because they help get rid of financial problems in a short period of time. It doesn't matter if it's an emergency, illness, or a broken car - Payday Loan from Direct Lenders is a good chance to solve your problems.

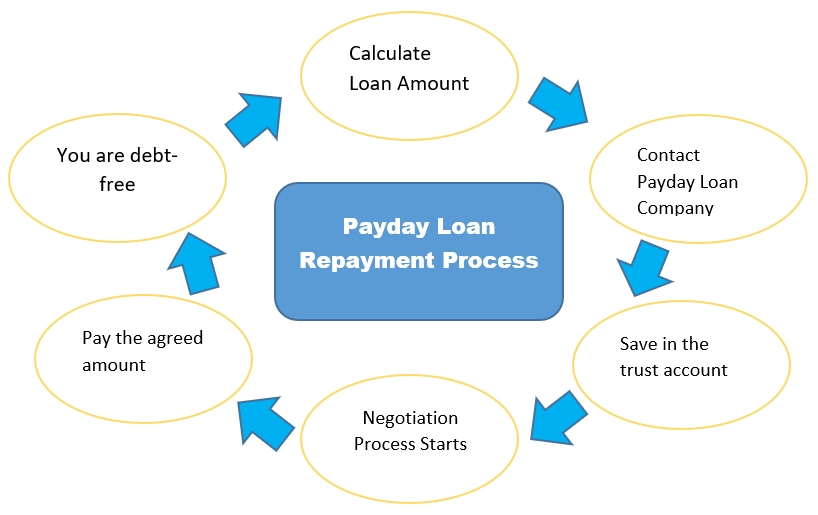

The payday loan amount and the duration of the repayment depend on the lender you work with. As a rule, you can receive an amount from $ 500 to $ 3000 and pay it from 3 months to six months. But before claiming a specific amount, you need to contact the lender directly and discuss the terms of the loan.

Ad

How do loans from direct lenders operate online?

Direct lenders are financial organizations that provide funding. Reputable direct lenders adhere to both state and federal laws, which means they are responsible for adhering to all lending guidelines established by each jurisdiction in which they conduct business.

Your interactions and communication with one financial institution will typically be the norm when working with online direct lenders. Your loan application, approval, receipt of funds, and loan repayment will all be handled by the same lender.

With online direct lenders, you can complete much of this process online, including the loan application. The fact that you can apply from any location with internet access may make things simpler for you.

Why choose a Payday Loan from Direct Lender instead of other loans?

As you know, payday loans are such courts in which the lender gives the borrower money for a month at interest. Many lending companies use indirect lending and work with the lender to obtain financing. Essentially, companies are intermediaries between you and the lender. But why do you need an intermediary if you can work directly?

Some loan providers are direct lenders. This means that they lend their own money to borrowers, not money taken from banks or other agencies. The convenience lies in the fact that you work with the lender directly and do not depend on any outside companies. Working with direct lenders simplifies the process of obtaining a loan and helps to get money faster.

How to apply for a Payday Loan from Direct Lender?

Since we understand that you urgently need money, we have made it as easy as possible to apply for a payday loan from a direct lender. More often than not, direct lenders do not check the creditworthiness of clients who wish to use payday loans, they offer no credit check Payday Loans. Of course, this is another advantage of working with them.

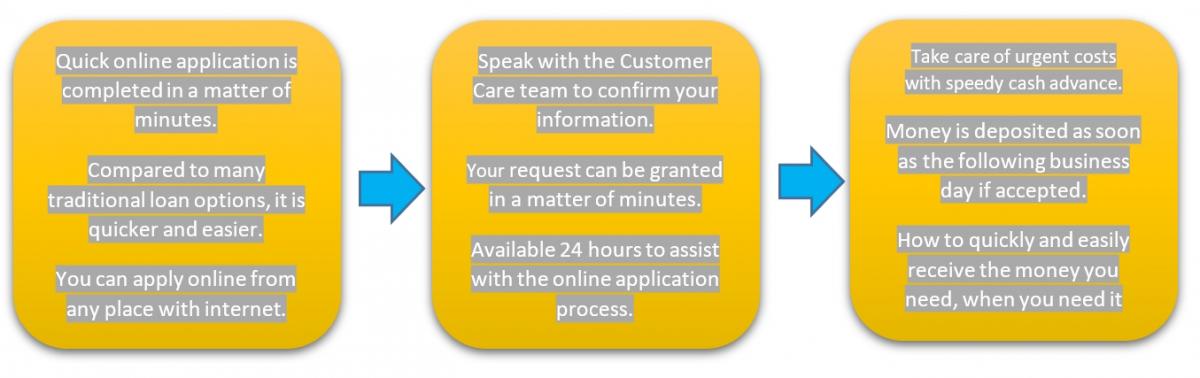

So, in order to get a Payday Loan from Direct Lenders you need to follow a few simple steps:

1. Apply for a loan. A simple form will allow you to fill out an application in just a few minutes. Direct lenders take care of your safety, so you don't have to worry about your personal data. Your information will not be shared with third parties.

2. Wait for approval. Lenders usually process an application within a few minutes. If you meet our requirements, the lender will immediately contact you to discuss the terms of your request.

3. Get paid. After confirming the application and discussing the details with the lender, you will receive a guaranteed payment. The money will be transferred to your bank account the next business day.

What are the requirements for obtaining a Payday Loan from Direct Lender?

While getting a Payday Loan from Direct Lender is not that difficult, there are still some requirements that you must meet if you want to get money quickly. Here are the main ones.

1. You must be at least 18 years old.

2. You must be a US citizen or permanent resident.

3. You must have a steady source of income.

4. You must provide your email and contact phone number.

5. You must provide your permanent residence address.

6. You must provide an active checking account.

A direct lender payday loan: How Do I Get One?

Payday loan companies are often modest credit merchants with physical locations where customers can apply for and be approved for loans right away. Online lenders might also offer some payday loan services.

You often need to submit pay stubs from your company that demonstrates your current level of income in order to complete a payday loan application. A proportion of the borrower's anticipated short-term income is frequently used by payday lenders to determine the loan principal. The salary of the borrower is frequently used as security. In general, lenders don't perform a thorough credit check or take into account your ability to pay back the loan.

Compare the Top Legit Payday Loan Direct Lenders like PaydayPlus

Please note that the rates and terms can vary significantly, so it's crucial to research each lender thoroughly. Also, remember that payday loans often come with high interest rates and fees, and they can be a costly method of borrowing money.

| Lender | Maximum Loan Amount | Loan Term | APR | Funding Time | Requirements |

|---|---|---|---|---|---|

| LendUp | $300 | 7-30 days | 200% - 1,000% | Next business day | Regular source of income, checking account, live in a serviced state |

| Payday Money Centers | Varies by state | 2 weeks -1 month | Varies by state | Next business day | Regular source of income, active checking account |

| Moneytree | Varies by state | Varies by state | Varies by state | Same day in-store, next business day online | Regular source of income, checking account, ID, US citizen or permanent resident |

| Check 'n Go | $500 | 2 weeks -1 month | Varies by state | Next business day | Regular income, checking account, meet age requirement |

| Rise Credit | $500 - $5,000 | Varies by state | 50% - 299% | Next business day | Regular income, live in a serviced state, at least 18 years old, checking account |

| Check City | Varies by state | Varies by state | Varies by state | Next business day | Regular income, checking account, US citizen or permanent resident, at least 18 years old |

| OppLoans | $500 - $4,000 | Up to 24 months | 99% - 199% | Next business day | Regular income, checking account, live in a serviced state, at least 18 years old |

| NetCredit | $1,000 - $10,000 | 6 months - 5 years | 34% - 155% | 1-3 business days | Regular income, checking account, live in a serviced state, at least 18 years old |

| Spotloan | $300 - $800 | 3 - 10 months | 450% | Next business day | Regular income, checking account, email address, at least 18 years old |

| LoanByPhone | $100 - $1,500 | Varies by state | Varies by state | Next business day | Regular income, checking account, US citizen or permanent resident, at least 21 years old |

The Bottom Line

Payday loans can be obtained without any kind of security or even a bank account and are intended to pay temporary costs. The drawback is that the fees and interest rates on these loans can be extremely hefty. It's crucial to understand what you'll receive and what is required of you before applying for one.

An immediate financial requirement in an emergency scenario may be met with a payday loan. But if you can't pay it back on time since these loans typically have a high APR, you risk being yourself in a never-ending debt cycle.

The bottom lesson is that you should carefully weigh all of your options or check CFPB before contacting a payday lender.