If you are in a difficult financial situation, don’t despair, because you can take out a loan of 400 dollars and pay your expenses and necessary bills. These loans are taken for 30 days and are usually called payday loans. Therefore, in case of financial problems, don’t worry, but choose a suitable loan for yourself.

Ad

400$ payday loan

Need 400 dollars fast? Online payday loans are non-bank loans granted over the Internet. Usually, it is characterized by relatively small amounts to be incurred, with a short repayment period (usually 30 days, less often for 45 or 60 days) and simplified formalities. Make $400 fast. One of their most important advantages is the speed of money transfer to your account. Sometimes payday loans online are interchangeably called short-term loans.

The loan sector, unlike banks offering cash loans, is subject to other regulations. They are freer, less restrictive and, importantly, they open the way for people with financial problems to obtain a loan. Payday loans are therefore much more available. In addition, the huge popularity of the network, its universality and possibilities mean an excellent space to offer quick and convenient loans.

Who needs a 400 dollar loan?

Clearly, not everyone needs a payday loan. If you have similar financial difficulties, and you can only get money in a month, then you should take out a loan of 400 dollars:

- The car needs urgent repair

- Not paid for urgent medical bills

- Necessary product

- Bills for utilities, electricity, and other services that may be disabled in case of non-payment

- Personal need

What you may expect with 400 dollar Payday loan

The easiest way to borrow money is from a friend, relative, or neighbor. You can also use a credit card to pay for your expenses. However, if you have a bad credit history, you won’t be able to get a credit card. If you have a bad credit history, the best option is a loan of 400 dollars before your paycheck. These lenders are not interested in your credit history. The only thing they need is information about your income to understand whether you are ready to pay off the loan or not.

Where can I get a $400 Payday loan?

Getting a 400 dollars loan is very easy and fast. Leave an online request on the site or in the app. Enter reliable information, the lender's misconceptions will reflect poorly on your rating. Submit your application and wait for approval. 80% of borrowers receive approval. Next, you need to discuss the terms of the loan with the lender and ask all your questions. You can refuse the services of this lender if you are not satisfied with its offer. If you are satisfied with everything, and you agree to the lender's offer, then you will have the money within one business day.

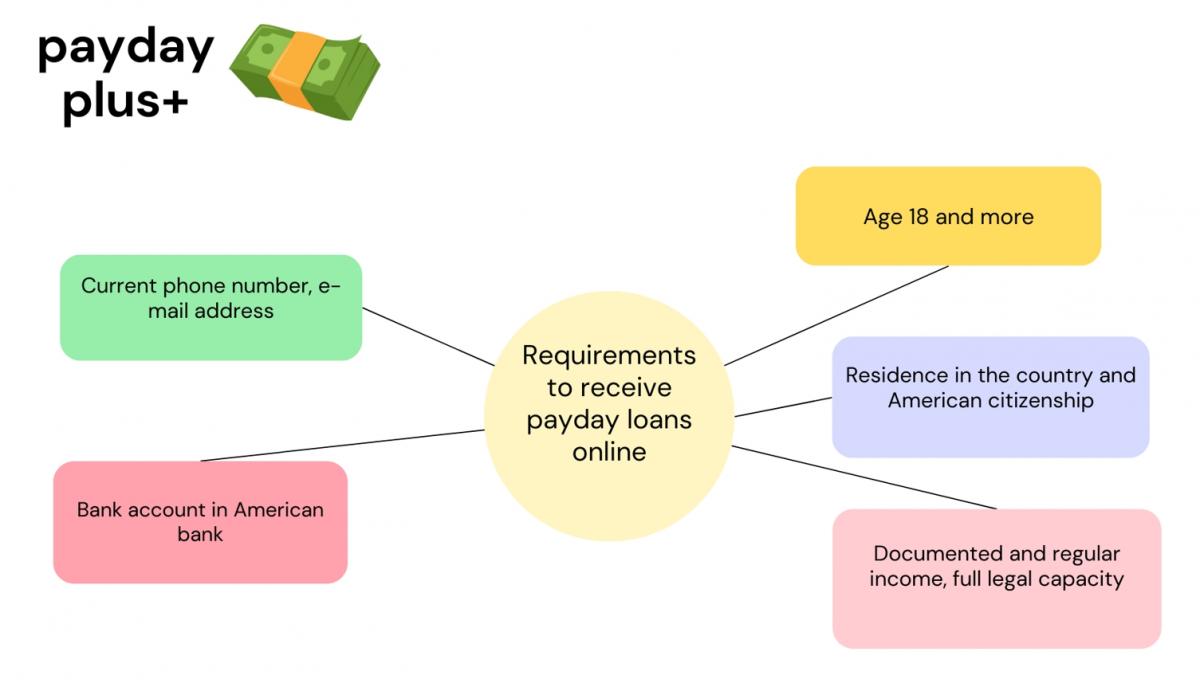

What do I need to get a 400 dollar loan?

Prepare the necessary documents in advance and follow the requirements to get approval quickly:

- Residential address

- Phone number

- The identity document

- Be over 18 years old

- Active Bank account

Each state has its own rules, so they may require other information. In some states, payday loans are not allowed at all.

Reasons to take out a $400 dollar loan

You can use these loans at any time. But try to use them only when you really need money and there are no other options for getting money. It will be much more profitable for you to take out a loan than to pay penalties for late payments. Each state has its own rules, so check the loan repayment process with the lender in all the details. In most States, rates are 15 dollars for 100 borrowed dollars. But in some States, rates are as high as 30 dollars for 100 dollars.

How to make 400 dollars fast?

Payday loans with a minimum of formalities, simplicity and speed of payouts are offered by non-bank companies in many areas.

Based on the research carried out, Payday Plus can say that the most popular way to get extra cash is the internet. All you need to do is go to the website of the loan company or use our ranking directly. Depending on the lender, set the interesting amount of payday loans online, as well as the repayment date. After verifying your identity, the funds from the loan will be on your account even in several minutes. This is an undoubted and valuable advantage of loans via the Internet.

24h loans - 24-hour 400$ payday loans

What to do when there is a shortage of cash and there is still a long time to withdraw? 24h online loans can be a good solution. Take a loan at any time of the day or night!

This is the best solution when you do not want or cannot take advantage of a cash loan at a bank. 24h loans, or otherwise popular 24h / 7 payday loans, are a good solution when you need to get 400 dollars now. In addition, you do not want to indebt too much and you simply want to return the money quickly and without unnecessary costs.

A cash transfer from a 24/7 loan will be instant if you have an account with the same bank as the lender. Fortunately, companies have accounts at a minimum - a few banks. Therefore, before submitting the application, carefully check whether the offer you will use supports instant transfers and has an account in your bank.

There are more and more companies that provide loans via the Internet 24 hours a day. The reason is trivial. More and more people need extra cash for unexpected expenses that may arise at any time. Due to the fact that fast, 24-hour payday loans do not require good creditworthiness, they are an option for everyone.

Are $400 payday loans safe?

Many people who are interested in taking advantage of a payday loan are concerned about the security of this type of services. This is understandable - we hear in the media about abuses in the non-bank loan industry. Perhaps they would not reach such a large scale if each of us took proper precautions. A safe payday loan is possible!

These are the most important rules that you must follow when taking a payday loan online.

- Use the services of proven and reliable companies that do not raise any formal doubts. Most of them can be found in our current loan ranking, containing only safe payday loans!

- Match the amount of the payday loan to the adequate expenses and financial possibilities.

- Keep an eye on the repayment dates! Otherwise, you will pay high interest for each day of delay.

- Do not sign the contract if any of its subsections are unclear. If in doubt, contact the company's consultant and dispel your concerns.

What to watch out for when choosing a 400$ payday loan?

Do not be afraid to use non-bank loans! The lenders we present are 100% reliable and trusted. Take security measures to be absolutely sure.

Avoid the services of companies with suspiciously little information on their website. If the lender does not provide exact address details, does not share his phone number or e-mail address - do not risk! Even when they are given, it is worth spending a few minutes to verify them.

Take a look at the opinions of past and current customers of the company. Admittedly, some of them may be the result of competitors' activities. However, the significant majority of negative comments should get your attention.

Does the company require registration fees when applying for a payday loan? Resign from further applying for a commitment. This is probably a form of extortion and the promised loan will probably never be seen.

Treat lenders' websites with reserve that do not provide information about costs, consumer requirements, and verified information that is the basis for granting a loan. Why? Remember that each lender is required to present the APR amount and any additional fees. Missing a pass is quite suspicious.

First 400-dollar payday loan without interest

Another important piece of information that we have partially mentioned concerns the first free loan. We write about it for a reason, because the first free online loan is a great convenience and benefit. It exempts you from any additional fees that drive up the cost of the commitment. Although they are a source of income for loan companies, at the first meeting with the client, they are an incentive and a factor that distinguishes the lender from the competition.

How quickly will I get money from payday loans?

When applying for a quick payday loan, you often need money for a very urgent expense. In this case, time plays a key role. There is also no doubt that you will only consider offers that guarantee instant funds withdrawal. Fortunately, there are many companies on the market that consider a cash transfer even in 15 minutes as the main point, so it is practically the first free loan immediately, so much sought after by many customers.

Then the method of transferring funds is very simple. The future consumer is usually verified with the use of modern algorithms that do not require the intervention of a consultant. In the realities of the loan market, they can transfer the loan amount in several minutes. So it is really a short time!

But what if the company does not use the quick transfer system, and you want to instantly receive payday loans on your account? Do not worry in advance and check if the selected lender has an account with your bank. This is the only "gate" that allows for a quick transaction of funds. Otherwise, you have to take into account that the money will reach you on the next business day at the latest.

What are the 400$ loan costs?

The first free payday loans are, unfortunately, only a fragment of the offers of selected loan companies. There are also entities on the market that do not specialize in first loans and impose additional costs on the consumer. What exactly makes up the costs of payday pay? Usually, these are interest or commission, as well as additional fees, such as a preparation fee, also known as an administrative fee. All total liability costs are shown in the form of APR, i.e. Annual Percentage Rate. Loan companies are obliged to include it with each offer!

Can you get a $400 payday loan with a bad credit history - without credit check?

There are times when you urgently need emergency cash, although you do not have good creditworthiness. Unfortunately, bad ability based on negative entries in debtors' databases effectively cuts the way to an attractive payday loan. Fortunately, and in this respect, the non-bank loan market has special products in the form of, for example, payday loans without credit check or loans with bad credit.

We warn you! Making this type of commitment involves high risk. Having debts, another commitment can lead to more financial problems. The so-called the spiral of debt is a "bottomless well" and ultimately results in debt collection and even enforcement proceedings! So we recommend that you seriously consider before taking any financial offer.