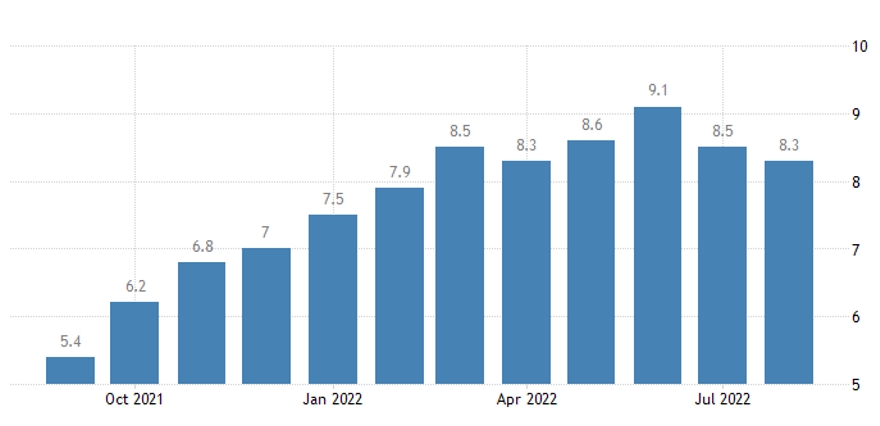

The global economy is facing high inflation in 2022. The USA is no exception. The annual inflation rate was high compared to previous years (figure). For some types of consumer goods and services, the inflation rate during 2022 had a maximum value over the observation period since 1979 (food, housing).

Figure - The inflation rate in the United States in 2022

To minimize the effects of inflation, the Internal Revenue Service has set annual inflation adjustments for 2022 for more than 60 tax provisions, including tax rate tables and other tax changes. The idea is to prevent taxpayers from losing various tax benefits. These provisions cover standard tax deductions, marginal income tax rates, exemption from the alternative minimum tax, the establishment of a maximum amount of the earned income tax credit, the modified adjusted gross income amount used by joint applicants to determine the credit reduction for lifelong learning, and as well as taxation of personal loans.

Are personal loans considered income?

A personal loan is a type of loan, the purposes of which are practically unlimited. It can be used, for example, to finance unexpected expenses, purchase or repair of a house, car, wedding, etc., as a short-term payday loan. Such loans are unsecured and do not require any asset for lending. Secured loans (such as auto loans and mortgages) use collateral to secure your loan. Because income is defined as the money you earn either by working or investing, personal loans such as unsecured short-term payday loans or car title loans, like other loans, are not considered income. When applying to a credit company for a loan, you do not earn on it, you simply borrow money with the obligatory condition of their return after the expiration of the loan agreement.

Are personal loans tax deductible?

Because personal loans are only borrowings and not income, they are not considered taxable income. In this regard, you do not need to report them to the tax office when informing about income tax. However, there are a few things to keep in mind that may have tax consequences for you. Your personal loan is a debt for you, which you must repay at the end of the loan agreement. Therefore, during this period, you have nothing to worry about. However, in case of violation of payment discipline on your part and the inability to pay the loan, part of your loan may be canceled. In this case, the creditor issues a document on the cancellation of the debt for a certain amount. This information will need to be provided to the tax office along with the tax return. For example, you took a loan up to a salary of $1,000. You paid $500 on time, and after some time you lose your job and are no longer able to pay the remaining $500. Contacting a lender will allow you to cancel the remainder of the $500 loan, but with the onset of the tax season, you will need to report the remaining $500 as income on your tax return and pay income tax on this amount.

Are interest payments taxable?

While there are some loans with taxable interest payments (such as student loans, mortgages, and business loans), interest payments on consumer loans, including short-term unsecured payday loans or secured Car Title Loans, are not taxed. And even if you used all or part of your consumer credit for business purposes, talk to a certified public accountant (CPA), accountant, or other tax professional before you inform the IRS when you submit your income information.