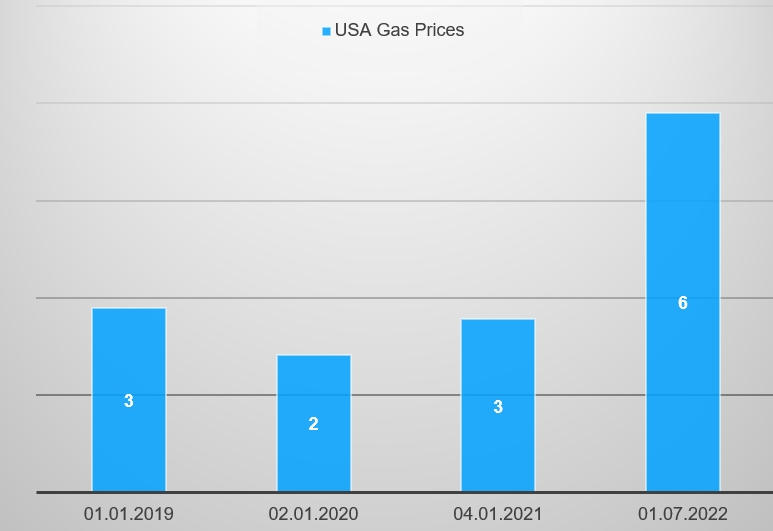

US fuel prices have risen by $1.8 over the past year. Americans try to save on fuel in every way, for example, they use applications to find cheap gas nearby or refuel on Mondays, since on this day the price of fuel is the most profitable. You can see the gas price increase over the past few years on the chart.

But what to do if even with all the tricks there is not enough money for gas? A great solution would be a payday loan, which you can get even within 15 minutes and not think that your last money will be spent on fuel. So what are payday loans?

Online payday loans for any urgent expenses including gas

Let's start by explaining what we call a financial product. It is a product offered by non-bank companies - lenders. Payday loans can be taken for small amounts - usually from 100$ to 1,000$. In addition, this financial product has a short repayment period - you can take out such an online loan for a maximum of 60 days - as well as minimal formalities and speed - money can be transferred to our account even within several minutes of submitting the application.

Payday loans for those in debt

An important feature of payday loans is that they are more accessible for people who have financial problems. Due to the fact that when applying for a loan online, there are fewer requirements than when applying for a bank loan, payday loans are more available for those in debt. In addition, there are also loan companies offering cash advance payday loans that do not check data in debtors' databases. This makes it easier for indebted people who need a cash injection.

Loan companies have different procedures for verifying a customer's credit information. You should always have a valid ID card, telephone number and e-mail address. In the case of poor creditworthiness, you still have a chance to get a loan, but the company may offer, for example, a lower amount than in the application or a higher interest rate.

A payday loan via the Internet - for whom?

When making any commitment, it is always worth carefully analyzing your financial situation. It should be remembered that payday loans (or installment loans!) are not a solution for those in debt to get out of debt. You can get in trouble when you take out new loans to pay off your current loans. This is a way to fall into a debt spiral - by taking another loan to pay off the previous one, you will not be able to pay off the latest one. Therefore, it is better to get along with the lender, apply for an extension of the repayment date and do everything not to use further financing.

In turn, a quick payday loan will be a good solution if:

- you were surprised by unexpected expenses and you need to quickly buy gas, fridge or repair the car;

- you are 100% sure that you will return the borrowed funds on time;

- you are short of cash, but you know that you will be able to return the amount borrowed to the lender after paying out.

An internet loan may be helpful in a crisis situation when you need $100 instantly. However, remember that the first loan for free requires you to pay back your funds on time. Otherwise, you will have to pay additional costs. So if you are sure that you will not be able to pay off the loan on time, give it up, because the costs may exceed you.

Are new payday loans free?

A free first loan is often the practice of loan companies. APR is 0%, so if you return the loan amount within the agreed period (usually 30 days or 45 days), you will not pay any additional interest or commission.

How to apply for emergency loan to pay for gas?

To be able to apply for a payday loan, you must meet a minimum of formalities. Usually, to be able to apply for a loan, you need to prepare: ID card, contact details, telephone number, bank account number. Then the identity is verified. Loan companies usually carry out it in two ways: through a verification transfer in the amount of $1 or by automatic verification by your bank account.

To get a loan, you must go through a simple procedure, i.e. indicate the parameters of the payday loan that interest you, complete the application form, verify your identity and wait for the loan decision. If it is positive, the transfer will reach your account even within several minutes.

The advantages of emergency payday loans

The biggest advantages of the financial product, which is a quick payday loan online, include:

- speed of the application process and receiving money - you can get a payday online in 15 minutes;

- availability - 24 hours a day, 7 days a week;

- a multitude of payday offers - everyone will find the right solution for themselves;

- minimum formalities - often, to apply for a loan, you only need an ID card and identity verification;

- money can be used for any purpose.