To investigate the changes in the payday loan industry, we collected the data on the “payday loan’ query from the Google Trends USA. Our finance experts brough together and analyzed the popularity of this short-term type of credit from 2018 to the current days. The figures are grouped by years, months, and seasons to keep a record of how many Americans search for a Payday Loan at different times and why.

Interest in Payday Loans from 2018 to 2022

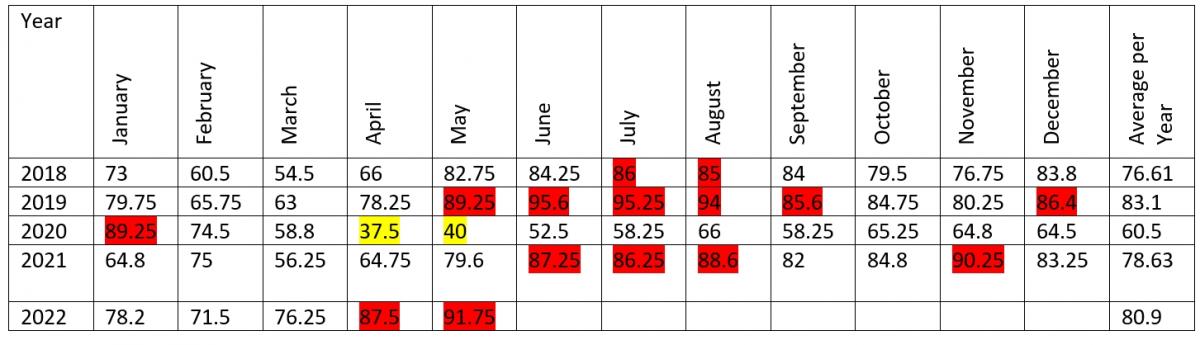

In the table below you’ll be able to see how the interest in small dollar loans has been changing since 2018. We’ve also calculated the average data for every year. Those months when the popularity of cash advance reached more than 85 are marked by red color and indicate a very high demand for payday loans.

Months with less than 50 – yellow figures, mean the times of the least payday loan popularity.

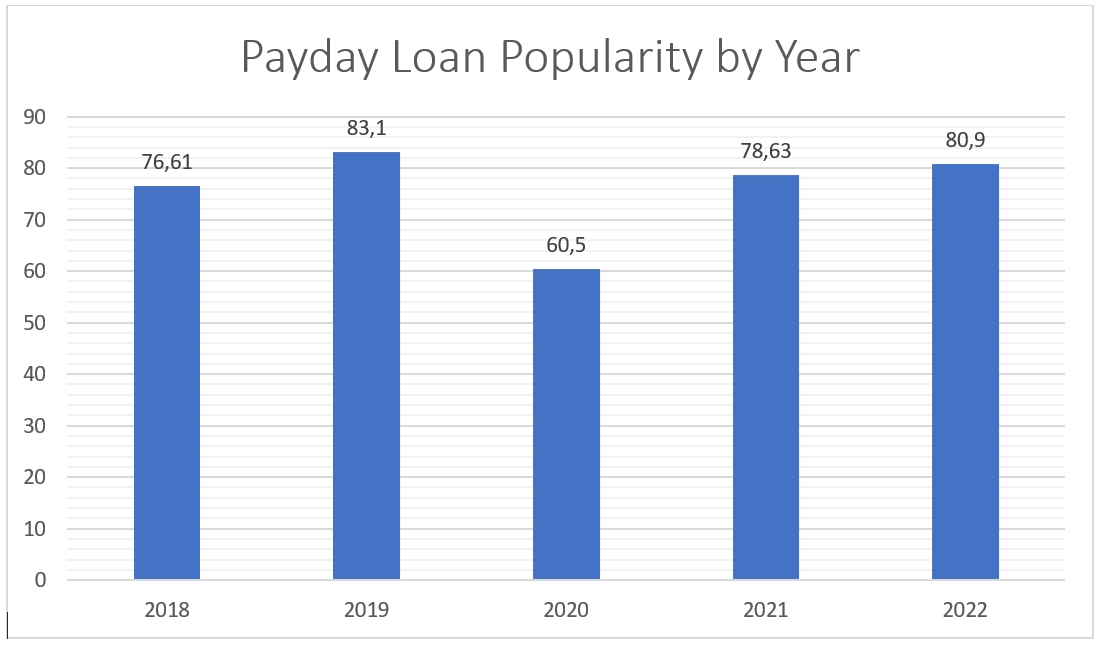

To make the example more vivid, let’s look at the diagram of Payday Loan rises and falls since 2018:

As the data show, Payday Loans were at the peak of their popularity in 2019. It may be explained by the following facts:

- 2019 is the year of COVID -19 which turned all the world upside down. Many people became unemployed, many needed expensive treatment, many died, and it all naturally led to urgent need for financing.

- Besides, the US Government already started planning Relief Programs, Stimulus Checks, Tax Relief, etc. which were announced in the media. This could make the US residents expect the coming help and feel more confident of loan repayments. That’s why they applied even for high interest payday loans. They just seemed more affordable as ever due to the future money help from the Government.

- In March, 2020 the CARES act promised all the eligible Americans financial help by means of the 1st Stimulus Check. And we immediately see a sharp decline in Payday Loan query. April and May of 2020 are the months when there were the fewest payday loans borrowed.

What can explain 2022 Peak of Payday Loan Industry?

The current rise in Payday Loan business in 2022 may be caused by deeper debt as well as higher expenses of the Americans. CNBC report states higher prices, higher overall cost of living, falling median income which all together lead to a bad lack of cash, more debt, more frequent loan applications.

According to the Ipsos data, among the most widespread answers to the question why prices keep rising are:

- Workers demanding pay rises

- The state of the global economy

- The Russian invasion of Ukraine and its consequences

- The policies of my national government

- The interest rate level in my country

- The COVID-19 pandemic

- Immigration into my country

- Businesses making excessive profits

Payday Loan Peak – Summer 2022

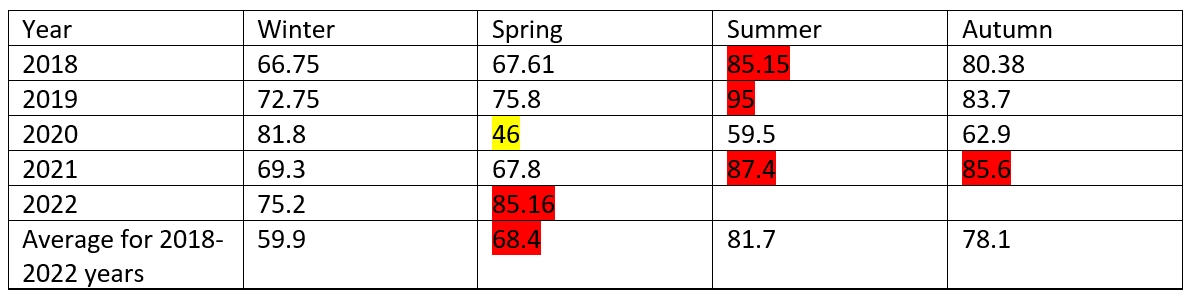

Aren’t you curious to know if your borrowing depends on the season? Can the time of the year influence our financial habits and behavior and why? To find out, we’ve summed up the figures on payday loan applications during each season within 2018 – 2022 years. The red marks show the seasons of payday industry boost while the yellow – decline in interest.

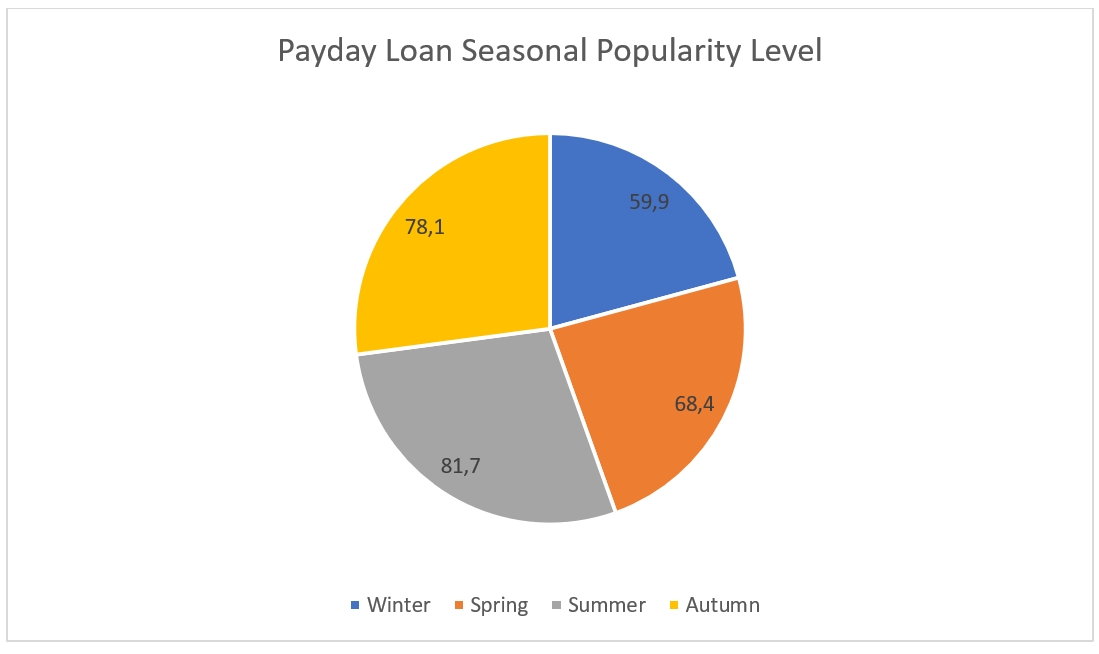

If we present the average data as a diagram, we’ll get:

And in the picture, it’s more than vividly seen that summer period is the time when Americans search for payday loans most of all. Why may people need loans more at a hot time of holidays and vacations? Let’s look deeper into the reasons. They are unlikely to boil down to the weather and relaxation.

According to the PewPaydayLendingReport, most payday borrowers use the money for their recurring expenses, not emergencies:

- Recurring expenses – 69%

- Unexpected emergency – 16%

- Something special – 8%

- Other – 5%

- Don’t know – 2%

Speaking about recurring expenses, we need to mention that they can be fixed and variable and are also dependent on the season. The survey on seasonal habits of the US residents showed that summer is the 2nd most expensive season after winter. The average expenses per person are distributed over the seasons in the following way:

- Summer - $2,229

- Winter - $2,314

- Fall - $2,064

- Spring - $1,952

Naturally, if your expenses grow but income stays on the same level, you need some extra money and the fastest and easiest way to get it is take out a payday loan. Up to $1,000 will be at your disposal within a day or two no matter what your purpose is.

Conclusion

If the number of borrowers in need of instant cash loan depends largely on the country’s economical and political situation, the number of loans taken within seasons is mostly affected by person’s psychology, expenses, financial habits, etc.

And while it’s hard to stay away from the economy or policy impact on your finances, it’s up to every human being to control their personal needs, plan the budget and make so much money that would be enough to cover all the current expenses.

We can freely confirm that we shouldn’t blame any circumstances of debt, lack of cash, and other emergency problems, we’d better start counting on our own education, skills, experience and desire to establish good relationship with money so that to feel safe at any case.