Just How Do Pay Day Loans Work?

Whenever people are considering a short-term loan, they immediately consider online loans. But, most are unacquainted with the idea and facilities offered by an easy and useful cash advance.

A loan that is payday is a small loan in a type of unsecured financing which calls for no security that will help you go through any emergency situations until your following payday comes. As soon as your income is in, you pay off the loan and then make your path back once again to building a great monetary foundation.

The part that is best about Payday Loans is that they are available for bad credit and no credit! Before you take up a payday loan if you are ever in a financially tight spot, here are a few things you need to know.

Ad

Payday Loan with No Third Parties Process

Once you submit the application, we only forward it to our trustworthy lending partners that can guarantee you a loan decision within minutes. Avoid lending scams. They comply with US laws and operate safely with your bank information while giving you cash advances. Therefore, be sure that nobody else is involved in the loan approval procedure.

The use of encryption technology makes these banking services completely secure. It is a technique that transforms data into encrypted codes that only the owner may access. Your private information's security is important to us. For this reason, we have established the financing procedure to be completely independent of third parties.

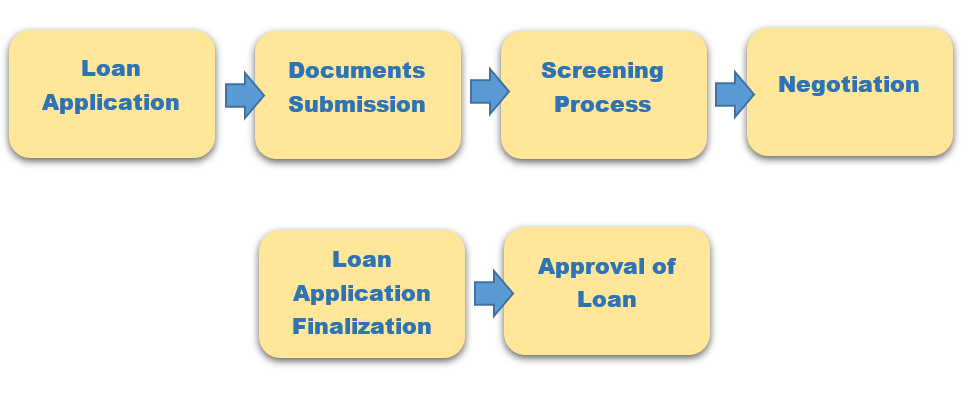

- Loan Application - The borrower must complete the loan application form.

- Document Submission - Either during the initial loan application process or following the pre-approval of the loan, the buyer or borrower must provide pertinent documents. To substantiate income, employment, financial situation, and other credentials, documentation must be verified.

- Screening Procedure - The lender now reviews the buyer's loan application, confirms the buyer's credentials, runs a credit check, and decides whether the buyer's income and financial situation meet the loan requirements.

- Negotiation - To obtain advantageous loan terms, negotiation may be required depending on the borrower's financial circumstances and the lender's approach to a loan.

- Loan Application Finalization - Once both the borrower and the lender have accepted the terms and conditions, the lender executes the loan application.

- Loan Approval - The lender evaluates the borrower's loan application carefully before deciding whether to accept or reject it.

Payday Loans Cost - Payday Loan Calculator

As a result of the limited time framework and not enough security for those micro financed Payday advance loans, these loan providers have a tendency to charge prices equivalent to bank card interest of 18per cent per annum, or 1.5percent each month.

Interest Calculation on a single Payday Loan taken out for Thirty Days

You would have to pay for a one month loan at 18% per annum would be calculated as such if you were to take up a 2,000 loan, the interest:

RM2,000 X (18% / 12months)

= RM30

Therefore, the full total you would need to repay for $2,000 loan principal would amount to $2,030 for a month’s loan. This really is as a result of the 2,000 dollar principal and $30 in interest.

Interest Calculation for just two Months Payday Loans

If you should be planning to simply take $2,000 during a period of 2 months at 18% you are going to pay $60 in interest as your repayment duration has stretched out.

RM2,000 X (18%/12 months) X 2 months

= RM60

Extending the tenure over two months can cost you an extra 30 dollars on interest, for the principal amount that is the same.

Guaranteed Payday Loan Fees and Terms

For every $100 borrowed, payday loans often impose a percentage or flat fee.

Depending on your state's laws and the maximum amount you are allowed to borrow, this cost might be anywhere from $10 to $30 for every $100 borrowed. $15 per $100 is a typical cost. For a two-week loan, this translates to an annual percentage rate of about 400%. Therefore, assuming a price of $15 per $100, if you needed to borrow $300 before your next payday, it would cost you $345 to repay it.

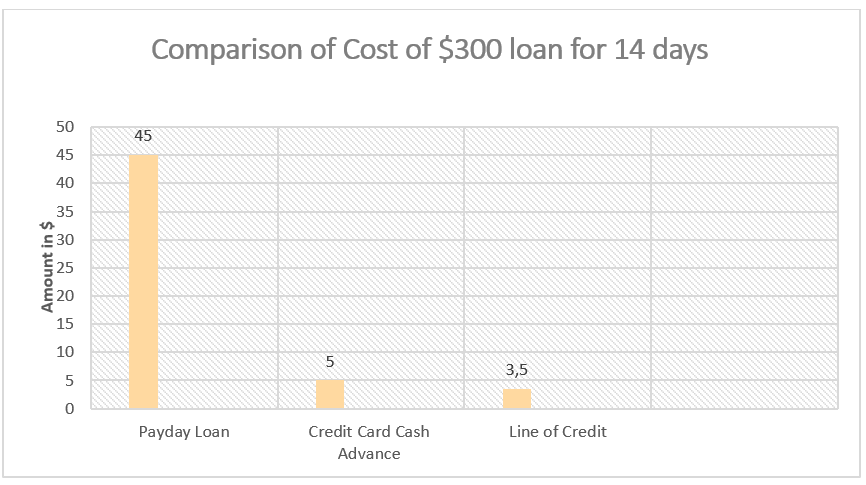

Although getting a payday loan can be easy, it can also be highly expensive. The overall cost of a $300 loan taken out for 14 days is nicely illustrated in the same study.

It is obvious that payday loans are significantly more expensive than other loans offered by banking institutions.

Payday Loan Repayment Strategy

The most readily useful strategy to increase the advantages of an online payday loan would be to minimize your repayment terms to be able to spend minimal interest, exactly the same way you’d treat credit cards.

Having said that, there is no part in using an incredibly short term if you might be not able to spend the entire amount in one go. Maybe you'd better consider paying back in installments and applying for Personal Loans.

Why choose a guaranteed payday loan with no third party?

In a bind during an emergency – such as a car breakdown – when you only need a small loan to pay for the repairs, applying for a credit card or a personal loan may take too long. Besides, your Personal loan may be rejected if you have bad credit or the loan amount is too small.

Needless to say, a payday loan should become your best resource whenever you’re really strapped for money. Stay away from it for unneeded items that may get you in debt – such as for instance a brand-new smartphone. Make smart monetary rather than borrow funds for leisure reasons.

Warning about Borrowing a guaranteed Payday Laon no third party

- You may not need a loan today. *

- It could be high priced to borrow lower amounts and money might not resolve your cash dilemmas.

Look at your choices before you apply for a Payday Loan:

- A cash advance is a loan of between $100 and $2,000 that is certainly repaid within terms of 16 installments to at least once a year.

- Any loan bigger than $2,000 is Personal Installment Loan.

Hot to apply and get guaranteed approval for a Payday Loan?

Whether or not somebody is approved for a quick payday loan depends completely on the direct lender:

- You need to provide proof of your income.

- Payday lenders typically accept candidates with bad credit. Loan providers glance at the applicant’s ability to rather repay the loan than their credit rating. But it is safer to check on the eligibility criteria first, to make sure there is the situation, before you apply. There are often limitations if you are currently or have already been bankrupt.

- If you’re unemployed. Unemployed candidates could be qualified to receive that loan.

Ad