Indian, castle, or tribal loans - what are they?

The average income of payday lending customers is similar to the overall US population. But the fact is that access to other credit options is often limited because of bad credit. In this case, better to use a tribal payday loan as an alternative to a common payday loan and also known under the names of Indian or Castle loans. The main difference is hidden in the location of the lender. However, tribal loans are followed with expensive fees that are often similar to direct lender payday loans and title loans.

Ad

What do Tribal payday lenders offer?

Tribal payday loans are offered by lenders based on tribal land. Since the Native American community is the landowner it leads us to the fact, that all tribal loans are not regulated. The lenders can charge whatever amount of interest and fees someone is willing to pay. It also means that tribal lending companies cannot be sued. As a rule, they have to follow common collection protocols. Although, it is always a good idea to contact the lender and work something out, as it is still illegal for them to harass, intimidate, or hurt borrowers. source

How to get a tribal payday loan?

People should not be given payday loans they have no chance of repaying. If your only choice is a payday loan you should be pointed towards free, impartial debt advice to help them address their money problems. If you want to apply for a tribal loan, check out if you qualify for it and fill in an application form on the website. Tribal or Indian loans are available for all online and you do not need to be part of a Native American tribe.

Tribal payday loan alternatives

When exploring alternatives to tribal payday loans, it is important to consider other short-term borrowing options that provide more favorable terms or lower costs. Here are some alternatives:

Credit Union Loans

Credit unions often offer small, short-term loans to members at lower interest rates compared to payday loans. They may also offer more flexible repayment terms and better customer service.

Installment Loans

Tribal Installment loans allow borrowers to repay the loan in multiple scheduled payments over time, often with lower interest rates and more manageable repayment terms than payday loans. This can help avoid the cycle of debt that comes with payday loans.

Personal Loans

Many online lenders and traditional banks offer personal loans with longer repayment periods and lower interest rates. Personal loans are typically unsecured, meaning you do not need collateral, and they can be a viable option for those with decent credit scores.

Nonprofit Assistance

Some nonprofit organizations offer emergency financial assistance, including interest-free or low-interest loans. These loans may come with financial counseling services to help borrowers manage their finances and avoid future debt.

Credit Card Cash Advance

If you have a credit card, you may be able to get a cash advance. While interest rates on cash advances can be high, they are often still lower than payday loans, and credit cards provide more transparent terms.

Negotiating Payment Plans

If you are borrowing to pay off bills, contacting your service providers to negotiate a payment plan may be a better option than taking out a high-interest loan. Many providers are willing to work with customers to set up a manageable payment schedule.

By considering these alternatives, borrowers can avoid the high fees and predatory practices associated with many tribal payday loans, gaining better control of their financial situation.

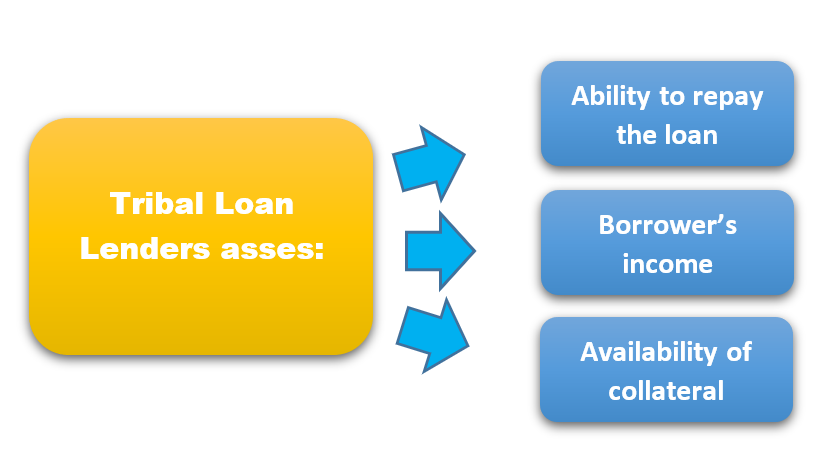

The process tribal lenders approve for loans

Your lender will make an assessment of your ability to repay the loan on schedule and your reliability as a borrower by looking at your cash flow. They'll also try to determine what security or collateral they might be able to get from you if you don't pay back the loan.

- Private Native-owned companies are permitted to use their own land as collateral for loans, but tribally held companies are not permitted to use trust lands as collateral. While some lenders have taken equipment that a tribe has acquired with the loan, some have accepted leasehold mortgage interests as security.

- The lender will also inquire about your credit rating. Unless you can find a source of collateral to secure the loan, a low score may prevent you from getting a loan. The lender will also look at how you have diversified your sources of income and how much debt you currently have. If your company depends too much on one particular source of revenue, a lender might be less inclined to provide you a loan.

- The lender might inquire as to whether you are investing any of your personal assets in your company in order to further assess your ability to pay. If you're relying solely on financing to launch or maintain your firm, they can raise issues.

- The lender will also make sure there aren't any legal issues that could damage the survival of your business, such as liens on its property, lawsuits, or unpaid taxes. Generally speaking, in order to qualify for a loan, you must demonstrate that your company has been profitable for the last three years.

Tribal Payday Loan Requirements

To borrow from the Native American Financial Services Association the borrower must:

- Show a steady employment

- Have a valid bank account

- Have an average monthly income of more than $3000. The income ratio is still variable from lender to lender, as an average NAFSA borrower is a middle-income American.

Benefits that could get from tribal payday loans

Anyone can apply for a tribal payday loan, and if you're strapped for cash they might appeal to you.

You can be unemployed, in debt, or in a difficult financial situation and yet qualify for a tribal payday loan because tribal lenders rarely evaluate an applicant's credit.

Additionally, compared to conventional payday loan lenders, tribal lenders frequently provide higher loan amounts.

|

Tribal Payday Loans |

Traditional Payday Loans |

|

More risky, as they might be difficult to repay |

Poor loan choices |

|

Regulated only by the local tribal government |

Fees are restricted by the US government |

|

Application is possible even if you are already in debt |

Might be difficult to apply for if you already have to repay the loan |

|

Tribal lenders offer greater sums of money often with no credit check |

Loan amounts are capped by the law |

Borrowers might use the money from a tribal payday loan to take care of pressing expenses in between paychecks. Borrowers are required to pay back the loan once they are paid.

Payday loans, unlike other forms of short-term credit or credit cards, are given to borrowers who might not be able to pay back the loan. As a result, customers who are unemployed, already in debt, or in another financially precarious situation might nevertheless be approved for tribal payday loans.

Tribal payday loans also frequently come with no credit check and immediate guaranteed acceptance, and they may provide borrowers a bigger loan amount than a regular payday loan. Because they may address several issues with a single loan, this may appear to be a desirable option.

Find the best Tribal lenders online

Please check if the lender you are willing to borrow from is NAFSA certified. The reason is that only members of NAFSA can guarantee the best practices on lending, operations, marketing, and payments.