A 600 dollars loan is taken out for 30 days, so it is called a payday loan. In case of a difficult financial situation, this type of loan can help you in a difficult moment. You can use loans as soon as you need money, but we advise you to use a payday loan only in extreme cases.

Ad

What Exactly Is An Online 600$ Payday Loan?

An online payday loan is a quick loan available online. It can be applied for after meeting the conditions set by the lender. These types of loans are offered by specialized financial institutions - non-bank companies. The characteristic features of online payday loans are:

- low loan amount - as a rule, non-bank loans concern lower amounts than a bank loan. In our case, 600 dollars;

- repayment period - usually it is a maximum of two months, therefore the payday loan is a short-term loan;

- minimum formalities - to get a payday loan online, most often all you need is an ID card and submitting an application online;

- attractive offer - sometimes the payday loan may be free (provided that the loan is repaid on time).

A payday loan is also called a quick loan due to the short waiting time for a loan decision and the speed of withdrawal of funds. The process of applying for a payday loan also does not take too long - it is maximally simplified, and the required formalities are limited to the necessary minimum.

It is worth knowing that the funds obtained from payday loans most often have to be returned quite quickly - usually in a one-off amount. Thus, payday loans can be a greater burden on the home budget than an installment loan. If we urgently need a small amount, such a quick loan may be a good solution.

What Are The Requirements For A 600$ Payday Loan?

The loan agreement is the most important document for those who took out a payday loan. It is the loan agreement that regulates such issues as the maximum cost of a loan, the amount to be repaid, the total amount of the loan, or what should be included in the contract.

It is worth noting that a consumer loan is simply a pool of funds transferred to a private person for any purpose (however, it cannot be related to business activity). In this sense, a consumer loan will be both a cash loan, a loan for proof, and an online payday loan.

In turn, the anti-usury act was to put an end to unfair activities of loan companies and protect the interests of borrowers. The main purpose of the anti-usury act is to reduce non-interest loan costs and to counteract the phenomenon of debt rollover. All legally operating financial institutions must adhere to its provisions.

When analyzing Google queries for $600 payday loans these queries turned out to be the most popular:

- 600 payday loan;

- 600 dollar payday loan;

- 600 payday loan online;

- 600 payday loan bad credit;

- how much will a 600 dollar payday loan cost me;

- loans without credit check.

From these queries, we can conclude that mostly people take 600$ payday loans online and with a bad credit history.

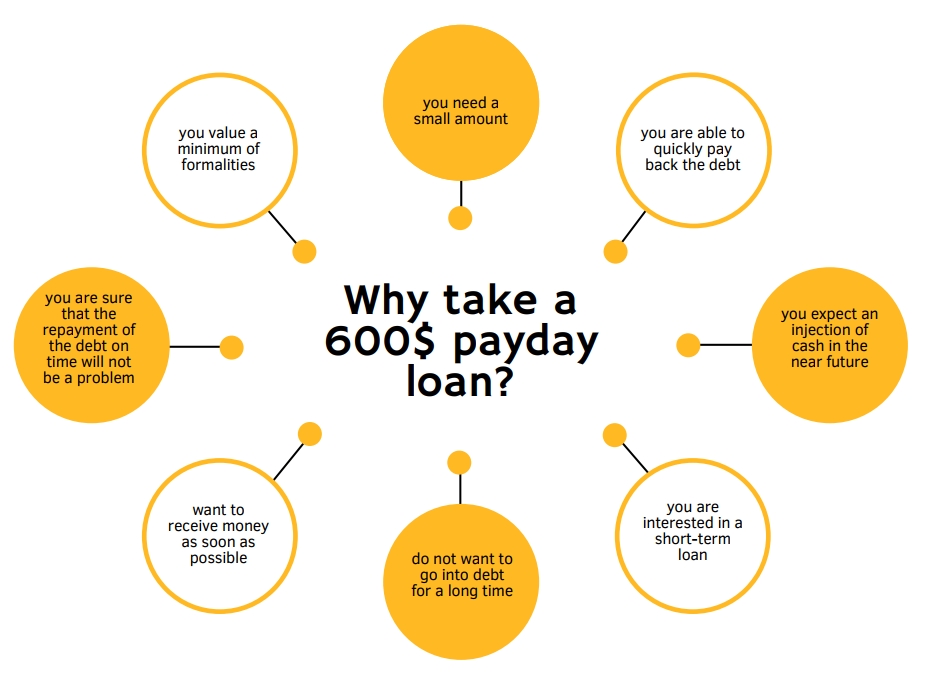

Why Take A 600$ Payday Loan?

What do I need to know before applying for a 600 dollar payday loan?

In many States, only loans up to 500 dollars are available. Find out if you can get a 600 dollars loan in your state. Before applying, ask your friends, relatives, or neighbors to lend you the amount, because it will be cheaper than a loan.

What Should You Pay Special Attention To When Choosing A 600$ Payday Loan?

|

Payday costs |

How much do you have to pay in total and how much is the interest, is the first payday pay for free, etc. |

|

Loan period |

For how long you can borrow money (what is the maximum repayment period) |

|

Repayment date and method |

When to pay the debt and to which account the transfer should be sent |

|

Additional costs, consequences in the event of non-repayment of the loan |

These may be charged to you for extending the repayment date or for returning the loan earlier |

|

Method of withdrawing funds |

Usually it is a transfer to a bank account |

|

Withdrawal time |

That is, when you will be able to use the funds received, it is particularly important if you have urgent expenses to settle |

|

Loan conditions |

What is needed to submit an application, what formalities you need to complete to receive money |

Requirements For A 600$ Dollar Loan

The conditions that the client must meet when applying for a payday loan are the following:

- being at a certain age - to apply for a loan, we must be at least 18 years of age and have full legal capacity. The same applies to the "upper age bracket". Loans are most often granted to people up to 76-80 years of age;

- having a bank account - a bank account is necessary both to verify our identity and to withdraw funds from the loan;

- ID card - if the client does not have such an identity document or it is invalid, he will not be granted an online loan. The ID card cannot be replaced by another identity document, such as a passport or driving license;

- constant income - its source may be an employment contract, a contract for specific work or a mandate contract. Income from retirement, disability and certain social benefits is also accepted. Importantly, the said income must affect client’s bank account. If the borrower works "illegally" or gets a payment "in hand", the company will refuse to finance him;

- having American citizenship - loans granted online (including free payday loans) are still loans for Americans only;

- e-mail address and telephone number - so that the loan company can contact you or send documents regarding our commitment;

However, you must be aware that when the loan amount is higher or the analyst has doubts about your financial situation, you will have to provide an account statement or a certificate of income. You will of course be informed about the specific requirements separately. However, if you are unable to provide the necessary documents, you will have to resign from the loan in the company. They are necessary to complete the application.

Can I get a loan up to 600 dollars if I have a bad credit history?

Enough people face the problem of a bad credit history or lack of it. However, for a loan up to a salary of 600 dollars, this is not a problem. Your income will be much more interesting to the lender than your credit history. However, not everyone gets a loan up to a salary of 600 dollars, because of mistakes made.

Instant approval for a 600 dollar payday loan with a bad credit history

Most people get approved for a loan up to a 600 dollars salary and don't worry about it. Lenders are not interested in your credit history and focus only on your income. Income information is important to understand whether you are ready to pay off a 600 dollar loan in 30 days. Be honest with the information provided to the lender.