Almost every person at least once in their life found themselves in a situation where they urgently need money, and there is no one to borrow. Online 700$ payday loan will help you deal with urgent expenses and repair your home budget. See what are the characteristics of quick loans online, how much they cost and when it is worth applying for them!

What is a $700 loan?

A $700 loan is a type of short term Payday loan repaid in a lump sum within 14 - 30 days. It can be obtained for any personal use like various emergency situations - car repair, urgent bills, etc. Most Americans often come across such situations when they run out of cash to cover bills or expenses. And they can't but say, ‘I need 700 dollars now.’ There's no reason to get in despair. There's always a way out - and 700 dollar loans are a good option used by many borrowers.

How To Take Out A 700$ Loan Online?

An internet loan is a good solution when you have found an expense that cannot wait (e.g. a prescription to be filled, a doctor's visit, repairing a washing machine, a child's class trip, new shoes in the spring, etc.).

All you need to do is submit an application online and the funds will be delivered to your bank account immediately. By visiting the website, you will have to:

- choose the loan amount of 700$;

- choose the repayment period;

- see the estimated amount of the monthly installment;

- check the cost of the loan;

- check what the Annual Percentage Rate is;

- fill out a loan application by providing the required data;

- wait for the credit decision and send the required documents (e.g. a scan of the ID card);

- sign a loan agreement (if all provisions are clear to you).

However, before you apply for a loan online, you must consider whether you can pay it back from your current income. If so, such a product will definitely help you deal with your expenses.

It is also good practice to familiarize yourself with the available loan offers. A loan calculator or a financial comparison site will help you with this. If you have been granted a loan online, remember to pay it back on time! This will increase your chances of receiving another commitment in the future.

Why people need 700 dollar loan?

- Your vehicle unexpectedly broke down and you can't get to work or school

- You got sick or injured and need to pay medical bills

- You lack money for everyday expenses like grocery

- You must pay utility bills

- Other emergencies that have put you in a difficult financial situation

When Will The 700$ Payday Loan Be Transferred To The Account?

Due to the fact that the 700$ payday loan is in most cases paid in the form of a transfer, you will receive the funds much faster than if you were to receive cash in your hand. An application for such a product can be submitted online, and the verification of the application and signing the contract also takes place remotely. Thanks to this, you save time and you do not have to visit any facilities or meet with a lender. You will be informed about the specific time of withdrawal of funds from the payday loan before signing the contract. Also remember that the time of receipt of the money also depends on the hours of the transfer sessions in individual banks. If you have an account in the same institution as the lender, you will get the funds immediately after they are sent. If you want to receive money faster, you can apply for it during the working hours of the loan company.

What Is The Total Cost Of A 700$ Payday Loan?

Online loans are famous for being more expensive because their costs are higher than those imposed by banks. However, it is worth remembering that the maximum limit of online loan costs is legally set, and lenders offering payday loans usually comply with it. A good measure that allows you to compare loans online and see which one is cheaper is the APR, i.e. the Annual Percentage Rate. It includes all liability costs, such as interest, commission, preparation fee or compulsory insurance (if any).

The general rule is that the smaller the APR, the cheaper the online loan is. However, it should be remembered that the measure is compared to the annual scale, which means that you have to compare products for the same period. In the case of short-term online loans, the APR value can be as high as 400%. This does not mean, however, that they are extremely expensive, but that their APR has been compared to the annual scale. With regard to such products, it is better to pay attention to the total amount to be repaid.

The total cost of the loan online depends on the specific offer, but also on the amount borrowed and the loan period. The more funds you want to get and the longer you pay them back, the higher the total cost of financing will be.

The cost of a 700$ online loan consists of:

- percentage,

- commission for granting,

- a preparation fee (also known as an application fee),

- insurance (optional and not available for all offers).

Therefore, if a given item in the contract raises your vigilance, remember to clarify it with the lender as soon as possible. Pay particular attention to the repayment period, the amount of interest, the amount of the total loan amount, the commission, as well as insurance, which is sometimes required. Also check what awaits you if the loan is not repaid.

Deadline For The Repayment Of A 700$ Payday Loan

The date of repayment of the non-bank loan is specified in the loan agreement. You will find in it the payment dates of individual installments.

The transfer should be made to the bank account indicated in the contract. Sometimes the transfer should also have an appropriate title. It is worth paying attention to this before transferring the funds. Remember that if the payment date for the next installment falls on a holiday, it is worth doing it earlier. You will then be sure that the money has reached the lender on time.

If you are afraid that you will forget about the payment in a given month, you should order a payment order for a specific amount at the bank.

Although the date of repayment of the non-bank loan results from the contract, you always have the right to return the loan ahead of schedule. This applies to both the settlement of the entire liability and its partial repayment. It is good practice to inform the loan company of your intention and ask for the related fees to be presented.

In a situation where you are not able to repay the loan on time, you should also contact the loan company. Remember that avoiding contact will not make our debt magically disappear.

The Most Important Advantages Of An Online 700$ Loan

The most important advantages of an online loan are that it is easily available. Loan companies approach the assessment of creditworthiness more leniently than banks, so even if you have a bad credit history, you can still count on a positive decision in the non-banking sector. For this reason, an online loan is sometimes called a loan for those in debt.

An online loan is also convenient to apply. Most of the products are like this because you don't have to wait for the branch to open, but you can submit an application on any day of the week and at any time. It is also much more convenient to fill in the application in the comfort of your house. However, the loan company's operating hours and banking sessions should be taken into account. It is these two issues that will determine when you will receive the transfer and how long you will wait for the money from the loan.

The advantage of an online loan is also that the entire process takes place remotely, so you do not have to travel anywhere or stand in a queue. Thanks to this, you also save time, because you can arrange everything without leaving your home - on any day and at any time.

In addition, the online loan is also extremely discreet. Only your creditworthiness is checked and if you do not want to, you do not have to share your decision to apply for a loan. The money is deposited in your bank account, so you can use it by making a transfer or paying by card.

What you should consider before taking a 700 dollar loan

A $700 payday loan is not the best way for every borrower. Be careful about high interest rates and fees charged for Payday Loans. It can be rather difficult to repay the money. Choose convenient repayment terms to make sure you don't default the loan. Consider all the possible alternative ways to get emergency financing including friends and family, credit cards, or traditional Personal loans. They may be cheaper and more affordable.

How to get guaranteed instant approval for a $700 loan?

A $700 loan is an easy and safe way to get the funding fast. The online application takes 2 - 5 minutes. Provide accurate personal information in order to qualify for a loan. Once you submit the request, you get guaranteed instant decision from a suitable direct lender.

Most applicants for a $700 loan are approved and receive the money same day. Before accepting the offer study the terms and conditions carefully, make sure you can afford this 700 dollar loan.

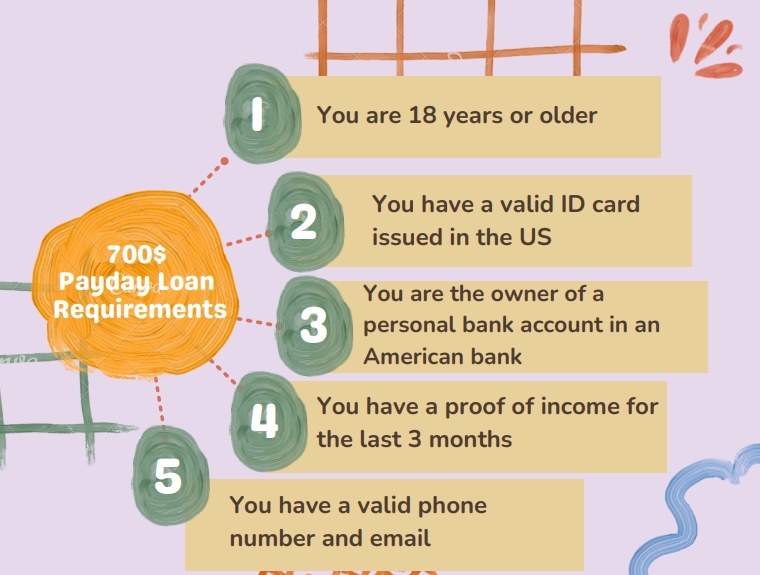

700 dollar Payday loan eligibility criteria

There are some basic $700 Payday Loan requirements:

- US residence

- Valid phone number

- Valid ID document

- Over 18 years of age

- Active bank account

There may be other eligibility criteria depending on the lender or on your state of residence.

Get $700 loan even with bad credit

Poor credit or no credit won't prevent you from getting approved for $700 loan. If during the last few months you've had a stable income you'll be able to take out 700 dollars even with bad credit score.

Is it possible to get a $700 loan with no credit check?

Most legit direct lenders do not do hard credit checks. The primary requirement to qualify for a $700 no credit check payday loan is having a regular monthly income of at least $1,000. You can also qualify for smaller Payday Loans - $300 loan, $500 loan, etc. with no credit check.

Just check your state’s short-term loan laws to see the maximum allowable loan where you live.

Your first step in getting a $700 loan is to take a few minutes and complete our short, secure, loan application form.

Can I get a 700 dollar payday loan today?

Yes, you can get a $700 payday loan now. We can help you get the $700 loan or whatever amount you need. You can trust your emergency financing problems to PaydayPlus.

Where can I get a $700 loan for an emergency?

PaydayPlus is an experienced reliable company for any emergency loan including a $700 loan.