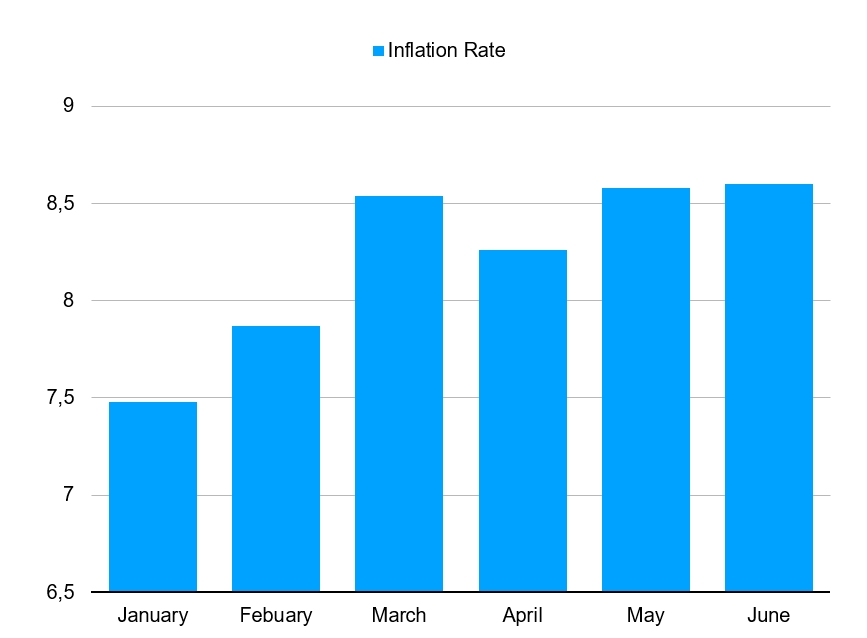

Over the past few months, inflation in the United States has reached significant proportions, which has left many Americans in a stalemate. The prices of groceries and other necessities have risen significantly, and many people are urgently looking for quick cash. If we consider the dynamics of inflation over the past six months in the diagram below, we can conclude that by August 2024 inflation will reach peak values.

It is worth noting that consumer inflation reached its peak in June 2024, when it exceeded the mark of 9 percent and thus broke records since November 1981. Today (July 2024) this mark reaches 9.1 percent, which allows us to conclude that by August inflation will reach even higher rates and beat all records. It is these numbers that allow experts to conclude that such types of loans for small amounts like 600 dollar loan will reach the peak of their popularity in August.

Are Gas Prices to Blame?

Economic experts also argue that it is rather difficult to predict the further development of inflation, as it largely depends on fuel prices in the US.

European countries, as well as the United States, decided to completely stop using fuel from Russia after its invasion of Ukraine. This event exacerbated the already rising prices due to the pandemic. All this is also superimposed on increased prices for airfare.

If we talk about gas prices, they increased by $1.8 from last year. Americans have switched to serious methods of saving and are already using all sorts of tricks to save money. For example, refueling on Mondays (on this day there is usually a decrease in fuel prices), using various reward programs or applications to find cheap fuel nearby. Many of them just live with obsessive thoughts "I need $500 today". This is natural, as economists are more inclined to believe that prices will continue to rise during the summer of 2024 anyway.

At the same time, retailers began to analyze prices and realized that there were more goods left than originally planned, which led to discounts and various promotions. Carriers also say they are working to settle the issue of transportation and delivery of goods, which will allow to regulate prices and consumer inflation.

Still, experts expect a subsequent increase in inflation by another one percent by the end of the summer. But the question arises «will this be the final peak, or should we expect further inflation? » Hard enough to predict. It is natural that such consumer inflation takes away the purchasing power of consumers and they turn to loans in 1 hour.

Speaking of the Federal Reserve, experts say the hot numbers should confirm the fact that the central bank will add another 75 points to June's three-quarter point hike. If the basis point is higher than expected, then it will definitely be a peak. If lower, it will give hope that the inflation rate is declining or at least slowing down.

Economists count on retail income in July rose 1.0%, up from a decline of 0.3% in May, in accordance to Dow Jones. A large section of the headline retail income achieve is predicted to be fuel sales.

What about loan forecast for 2024?

During the Pandemic, there used to be certain decline in personal loan query. Lenders imposed various restrictions as the economy was in a dangerous state. Nowadays, the situation seems to be improving and lending companies tend to offer more loan options. The requirements become simpler and gettin a loan is much easier.

What concerns interest rates, they are not subject to growth. Naturally, low rates on personal loans and easy access are likely to lead to the peak of loan popularity in August, 2022. Besides, August is one of the top months when people do need some extra cash. It may be explained by the coming school season, or vacation, or any other factors. Anyway, finance experts predict the growth of lending in the USA in 2024.